December 22nd, 2020

With interest rates at historic lows, many family office managers may be looking for new ways to produce consistent returns that are uncorrelated to broader equity markets.

Some managers have already found new ways to grow their capital with alternative credit investments. According to the New York Federal Reserve, the amount of non-housing consumer debt is over $4 trillion.

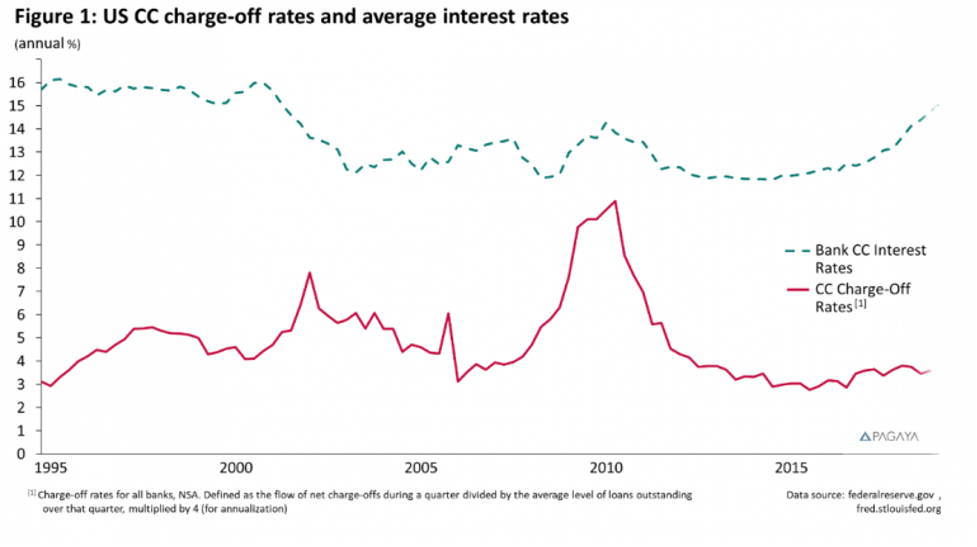

US consumer credit represents one part of this asset class, with investments sourced from marketplace lenders (MPLs) — non-bank entities that serve as a platform for joining lenders and borrowers. In the last five years alone, more than $23 billion in loans have been issued from MPLs globally, with more than 50% of this total concentrated in the US. Consumer credit is a notably resilient asset class, performing well even during the height of the financial crisis, with charge-off rates remaining well below interest rates. The bottom line? On average, consumer loans remain profitable for lenders even during periods of significant economic instability.

There are three primary reasons why US consumer credit (and the wider alternative credit umbrella) may benefit family office managers:

In the wake of the financial crisis, central banks have been employing extreme strategies to get their economic engines running (some banks lowered their lending rates to 0 and in a few cases, even lower). But despite these drastic measures, in Japan and most of Europe there is still little sign of the robust growth needed to warrant a hike in interest rates. That means investors can’t rely solely on government bonds as a reliable source of returns.

still little sign of the robust growth needed to warrant a hike in interest rates. That means investors can’t rely solely on government bonds as a reliable source of returns.

Family offices (who manage nearly $6 trillion in assets) have typically used hedge funds to navigate the market. But research from UBS and Campden Wealth shows that today only 5.7% of family offices actually sit in hedge funds, a sharp downturn from recent years. Meanwhile, their allocation in public markets is also falling, with just 28% in equities and 16% in bonds.

By contrast, family office investment in alternative credit is on the rise, with private equity allocations at 22% and real estate investment increasing to 17%. This growing trend reflects thefamily office’s appetite for the kind of high yield, uncorrelated investments they can no longer achieve with hedge funds alone.

Since the collapse of the Iron Curtain, the global economy has become increasingly interconnected, from integrated supply chains, to lowered labor costs, to the proliferation of new technologies. As a consequence, investment returns have likewise become more correlated. Factors like tariffs, civil unrest, and geopolitics all influence the return of investments across different classes. Because of this reality, investors today need an even more sophisticated diversification plan. For many, this plan includes alternative credit.

By accessing alternative credit as an asset class, family offices can construct a portfolio that is less anchored to traditional equity/bond risk factors like economic growth, inflation and liquidity. Additionally, alternative credit gives managers new ways to drive asset growth in a way that doesn’t depend on broad equity market performance alone (in one quarter of 2019, just five companies in the S&P 500 represented more than 30% of the index gains).

By contrast, alternative credit assets, characterized by short-duration and high-yields, have a low correlation to the broader market.

The data which moves today’s market is vast and limitless. To discern the signal from the noise requires formulating a robust approach that’s designed to handle the influx of information drivingthese markets. An AI-driven strategy offers several unique benefits:

As the investment market matures, family office managers will need to introduce new tools to grow assets in a way that satisfies their fiduciary obligations. The alternative credit asset class offers the possibility of both accelerated returns and improved diversification — magnified by the power of AI strategies. All of these factors combine to promise scalable benefits and consistent returns to the managers who employ them.